Issue #2

Understanding the Mendoza Line for SaaS growth | The Blackstone of Innovation | LVMH and The Luxury Strategy | Free Tools- Data Journalism, Tom Tom Traffic Index

Orchids And Hummingbirds by Martin Johnson Heade

Source: Artvee

VC 🚀

Understanding the Mendoza Line for SaaS growth

By TechCrunch

Annotations

The Mendoza Line is a baseball term for the batting average below which a hitter will not qualify for Major League Baseball.

In the context of startups, the Mendoza Line for Growth, helps in the identification of a growth rate at every stage of a SaaS startup, below which that company is not on a clear, venture-backable trajectory.

The line is based on two assumptions:

Most investors prefer to invest in companies that may get listed on the stock exchange and at the time of listing the company should ideally have annual recurring revenue of US$100M and a projected growth rate of 25% or greater in the following year.

Growth rates decline but in a predictable way. For a leading SaaS company, the growth rate for any given year is between 80% and 85% of the growth rate of that same company in the prior year.

The Blackstone of Innovation

By Investing 101

Annotations

Fund managers have two primary revenue streams: management fees (fixed), and performance fees (vary with returns). And they typically follow the 2 and 20 model.

When fund managers raise larger funds-

They can collect more management fees (since it’s based on assets under management).

Their return threshold falls, as it’s harder to 2X a US$1B fund than 2X a US$100M fund.

So a VC firm is incentivized to raise larger funds and earn more fees from its limited partners (LPs). Since customers are the primary source of revenue and both management and performance fees are earned from LPs, a VC firm’s actual customers are LPs and not founders.

Finance 💴

LVMH and The Luxury Strategy

By Punch Card Investor

Annotations

Luxury brands need to balance the tensions between:

Scarcity and diffusion (growth and sales)

Heritage and modernity

Luxury has a peculiar problem where growth creates a loss of desirability.

Pricing rules that luxury brands should abide by:

Increase prices over time to increase demand.

Raise the average price of the product range.

LV would rather burn unsold items than discount them, if it means ensuring brand equity.

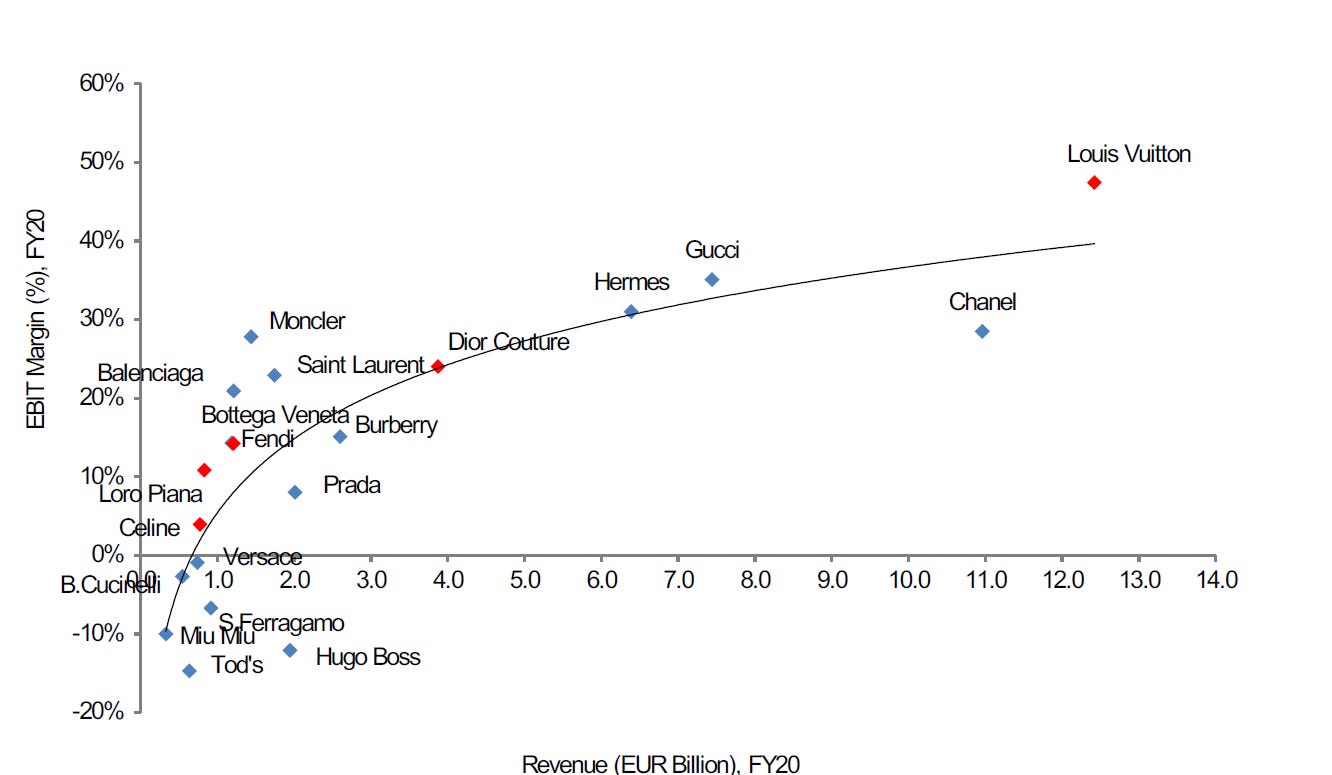

Source: Punch Card Investor

Caption: LV is far ahead of other luxury brands in terms of operating margins and revenues.

Under Bernard Arnault, the current Chairman and CEO of LVMH, the luxury conglomerate pioneered the playbook of vertical integration and establishing control over the entire supply chain. This ensures high-quality products which are sold through their own store networks.

In contrast to traditional supply chains spread across the globe, most of LVMH’s production happens in high-cost countries, usually in the country of the brand’s origin. This is a key strategy in the luxury playbook-once a luxury brand offshores the production of its primary product, it risks impairing its luxury status.

When people buy a luxury item, they are buying a product steeped in a culture or a country.

Bonus 🎁

Why did the Kursk sink?

This is an amazing example of scrollytelling (scroll + storytelling) which recounts the tragedy involving the Russian submarine Kursk.

Free Resources 💡

Data Journalism- The best free resource to learn new skills related to data journalism.

TomTom Traffic Index: Absolute goldmine of global city traffic statistics showcased as beautiful data visualizations.

For more free resources (150+ websites and tools), please check out Searching (it’s a Notion database that I’ve created).